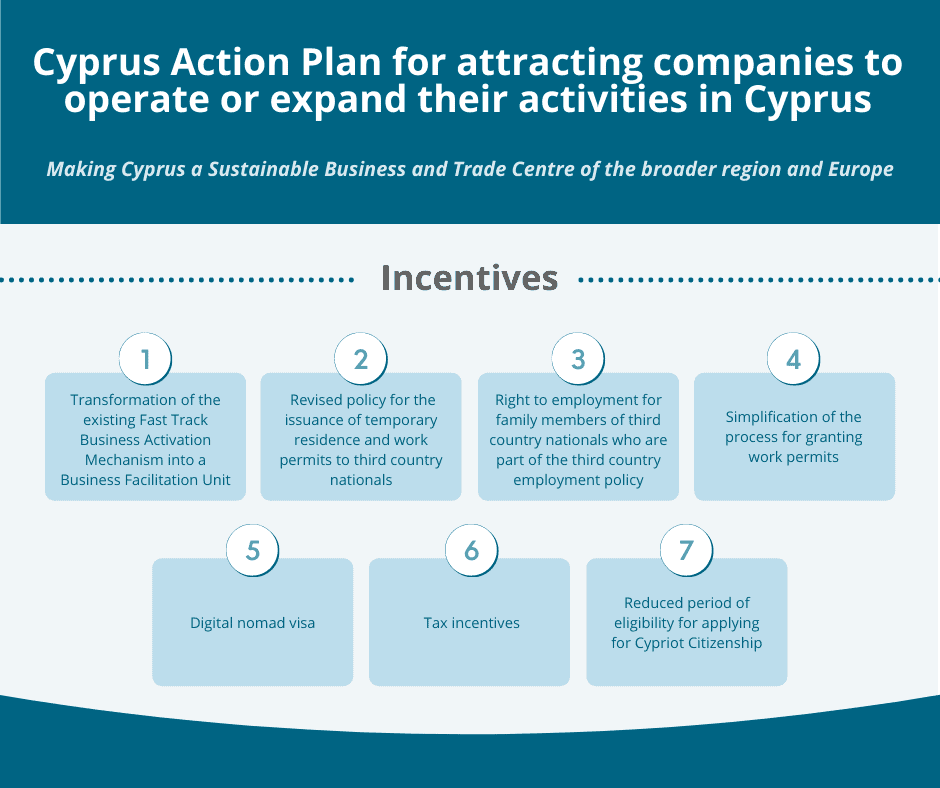

On 15 October 2021 the Cyprus government presented its Action Plan for attracting companies to operate or expand their activities in Cyprus, in an attempt to make the island a Sustainable Business and Trade Centre of the broader region and Europe.

The Action Plan will be implemented as from 1 January 2022 with the exception of actions 6-7 for which legislative regulations are required.

The key points of the Action Plan are briefly summarised below:

Transformation of the existing Fast Track Business Activation Mechanism into a Business Facilitation Unit to function as the central point of contact for all companies of international interest, either operating in Cyprus or wishing to operate in the country, as well as for Cyprus companies in specific areas of economic activity. The unit will provide services for the establishment and operation of corporate entities and facilitation for the issuance of residence and employment permits in Cyprus.

Revised policy for the issuance of temporary residence and work permits to third country nationals

Right to employment for spouses of third country nationals who have obtained a residence and work permit in the Republic, under certain conditions.

Simplification of the process for granting work permits and determination of criteria based on which work permits will be granted.

A new type of residence permit will be introduced “the digital nomad visa”, for people who wish to live in Cyprus but work in companies operating abroad. Eligible persons are third country nationals who are self-employed or employees who work remotely using information and communication technologies, with employers/clients outside Cyprus. The permit will be granted under certain conditions.

Tax incentives

- Expansion of the existing income tax exemption of 50% for taking up employment in Cyprus

- Extension of the tax exemption for investment in innovative companies by corporate investors (The scheme that was in force until 30 June 2021 applied only to individuals).

- Increased tax deductions for Research & Development (R&D) expenses

The period of eligibility for applying for citizenship will be reduced from seven years of residence and work in the Republic, to five years.